Investing

beyond the stock market

One of the largest IPOs so far this year was Reddit, which debuted with a market cap of $6.4 billion. If you had purchased the stock in March at its IPO of $34 and held on through the end of August, your position would have been worth $60, marking a return of over 76%.¹

While this return profile may seem impressive, it’s important to look beyond a company’s IPO and consider its entire lifecycle. Early investors, such as venture capitalists and angel investors, in certain instances realize significant returns by investing in a company before its stock becomes available to the public on an exchange.

Consider Co-Founder of PayPal & Palantir Technologies, Peter Thiel, who famously invested $500,000 in Facebook back in 2004 for a 10.2% stake in the company. Just eight years later in 2012, Facebook went public with an initial valuation of $104 billion. Shortly after its IPO, Peter sold a portion of his Facebook shares for over $1 billion.¹

Note: 2024 market cap shown as of 8/31/24. Valuations reflected during the pre-IPO period of 2004 to 2011 include both the post-money valuation of priced fundraising rounds and estimated notional value based on proposed M&A transactions.

Source: The Wall Street Journal

Investing in public market securities, such as fixed income and equities, has historically stood as a cornerstone of portfolio construction, providing a broad, accessible, and regulated source of growth and income to investors worldwide. As of 2023, these markets total an astounding $255.7 trillion in size globally.²

In contrast, private investments, often referred to as “alternative” or “non-traditional” investments, have typically played a more secondary role. According to a recent report by McKinsey, global private investment AUM stood at just $13.1 trillion in 2023.³ While seemingly miniscule in comparison to the indomitable public markets, private markets have seen steady growth in recent years, nearly tripling over the past seven years from an AUM of $5.2 trillion in 2017.⁴

Sources: SIFMA, McKinsey ² ³ ⁴

This gravitation towards private investing has been fueled by a variety of factors, including increased accessibility, a desire for additional portfolio diversification, and the pursuit of high-octane returns which were once considered exclusive to the elite.

While this level of growth is undoubtedly impressive, we would like to take a step away from the excitement and break down the various flavors of private investing and how they relate to the construction of a long-term portfolio strategy.

Understanding the Stages of Private Investing

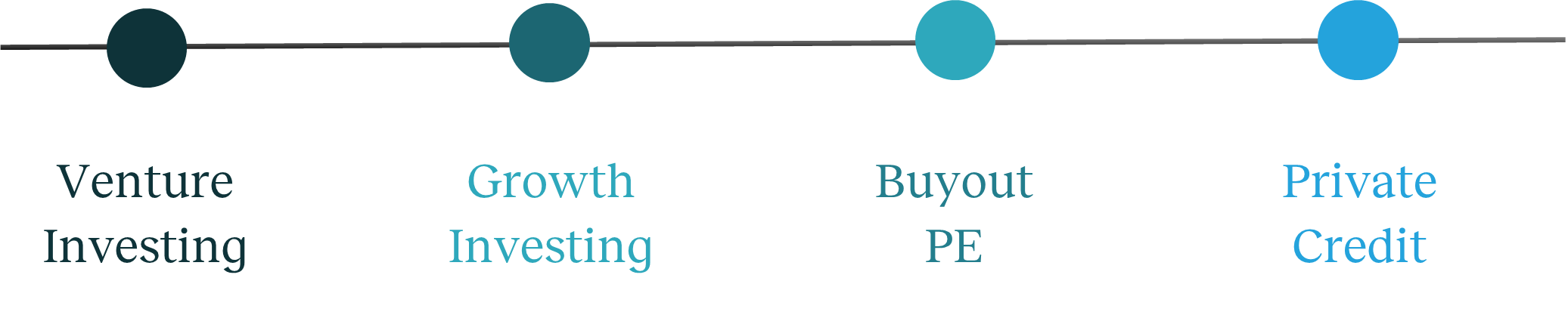

Private investing encompasses a range of opportunities across different stages of a company’s lifecycle, each with distinct characteristics and risk profiles.

Venture Capital (VC) involves early-stage investments in startups, which offer a high return profile in exchange for elevated risk.

Growth Equity (Late-Stage VC) targets more mature venture-backed companies, many of which have found product-market fit and use funds to expand, develop new products, or prepare for an IPO.

Buyout Private Equity (PE) involves acquiring significant stakes in mature, established companies to enhance performance and create value. These companies are typically financially stable but have lower growth potential than early-stage ventures.

Private Credit (Private Debt) refers to non-bank lending to small and mid-sized businesses, offering higher income potential and asset protection compared to public high-yield bonds. This sector has grown significantly since the tightening in banking regulation instituted after the 2008 financial crisis, with global assets exceeding $1.6 trillion as of March 2023⁴.

Private Investment’s Role in Portfolio Construction

When introduced thoughtfully, private investments can provide a creative source of diversification and enhanced return potential to a long-term investment portfolio.

Private investments, while considered to be on the riskier side of investing, have historically generated a higher Sharpe ratio when compared to their public counterparts. Sharpe ratio is a common tool used by investors to measure how well an investment’s returns compensate for the risk taken, with higher values indicating better risk-adjusted performance. The chart below compares the Sharpe ratio of various public & private asset types.

Public & Alternative Market Sharpe Ratios (5Y as of Q3 2021)

Source: CAIS Group

Source: CAIS Group

Private investments can offer attractive diversification benefits as part of an investor's portfolio. However, it's crucial to assess liquidity needs before allocating significant portions to private investments. Unlike publicly traded assets, which can be bought or sold at will during market hours, private investments are typically illiquid. This means that these investments cannot be easily converted to cash and often need to be held for several years before generating returns.

The Athos Philosophy

We believe that investing in private assets can be highly beneficial for building a long-term portfolio. To support this, our team has developed a range of in-house investments and strategies that offer access to the world of private investing. Our offerings are guided by the following principles:

Commitment Pacing: Allows clients to gradually deploy funds to private investments over time. By strategically pacing investments across a variety of vintages, clients can capitalize on strong years and balance returns over the long term, smoothing out fluctuations in performance.

Third-Party Investments: Combining a diverse range of fund managers and strategies into one investment vehicle. This approach enhances diversification by spreading exposure across multiple investments, enabling us to manage risk more effectively while providing broad access to various opportunities.

Risk-Return Profile of Private Investment Strategies

Source: Prequin

Direct Investments: We leverage our extensive network of venture-backed founders, executives, and early-stage investors to offer selective access to direct investments in startups. While these direct investments can yield significant returns due to their concentrated nature, they also come with higher risk compared to fund investments. To ensure we present only the highest quality opportunities, our dedicated private investment team conducts thorough due diligence on each potential investment.

Concluding Thoughts

Private investing can play a pivotal role in long-term portfolio construction by offering access to opportunities typically unavailable in public markets. When combined with public investments, private investments have the potential to enhance diversification and provide an attractive risk-return profile while supporting companies during their most dynamic phases of development.

By incorporating a moderate allocation to private markets, along with principles such as commitment pacing, investors can effectively manage risk and build the foundation for a well-rounded long-term portfolio.

While private investments can be a valuable component of portfolio construction, they may not be suitable for all investors. Prior to building a private investment allocation, it is essential to evaluate your individual circumstances and long-term goals to determine if private investments are appropriate for you.

Footnotes:

1. This return does not account for fees or expenses which would lower returns, and there is no guarantee of positive performance of an IPO or private investment or an Athos investment.

2. SIFMA Capital Markets Fact Book, 2024

3. 2024 McKinsey Global Private Markets Review

Alex ShigetaFor more information contact us at info@athoswealth.com